Inflation and insurance in Argentine

Since the invention and use of currency as a means of payment, the economy has historically been affected by inflation. Recently, since the SARS-CoV-2 pandemic and as a result of the rampant increase of this monetary phenomenon, inflation has returned to the political agenda of major economies. To illustrate, in the United States of America, one of the world’s largest economies, the inflation rate skyrocketed from a low 1.24% in 2020 to 8.01% in 2022.1 In Argentina, this problem is even greater, since inflation rates have been accumulating double digits annually for more than a decade and, as of October 2023, the data indicates 138.3% interannual rate.2

The purpose of this article is to analyse and describe in simple terms some of the effects of inflation on insurance contracts, particularly the relationship between the limits of insurance coverage and inflation. On that scope, we will review the different doctrinaire positions on adjustment or increase of coverage limit and the solutions provided by the case law.

Inflation and insurance

Inflation is an economic phenomenon that affects every sector of the economy, including the insurance industry. Simply put, inflation is the loss of the real value of an economy’s currency, which causes a generalized and sustained increase in the prices of goods and services in the market, i.e., less goods or services can be purchased with each unit of currency over time.

Since the price of goods and services increases for the whole economy, compensation claims also increase, consequently affecting premium prices and coverage limits. Although premiums and coverage limits may be adjusted through a clause in the contract or by the Argentine Insurance Regulator (the “SSN”) (in this latter case, in a limited number of insurance products), such solution does not certainly avoid the risk of under-insurance, which results in compensation substantially below the real value of the insured asset. With such clauses, although the coverage limit can be adjusted at the time of the loss, the adjusted amount can be outdated between the time of the filing of the claim in court and the ruling.

With or without an adjustment clause or a resolution from the SSN, the risk of outdated coverage limits is mostly common in those cases where long periods of time occur between the moment of contracting and the insurer’s actual fulfilment of the indemnity, especially if payment of the compensation is claimed in court. In Argentina, court times are usually extensive, while inflation rates constantly and exponentially increase.

Hence, it is necessary to provide a brief explanation of the main positions regarding the possibility of updating the coverage limits of insurance contracts, in view of inflation and court times as main factors.

Positions against adjustment

Proponents of this position rely on the notion that insurance contracts involve an obligation to pay a certain or specific sum of money. Pursuant to this obligation, the debtor, or the insurer in this case, owes an amount of money that was determined, or is determinable, at the time the obligation originated (Section 765 of the Argentine Civil and Commercial Code). The debtor will then fulfil its obligation with the payment of the amount nominally expressed in the contract at the date it becomes due. These obligations are linked to a nominal value rather than to a “real” or a “utility” value. Therefore, if the obligation established the payment of an amount of currency units, the obligation can be fulfilled with its payment, regardless of the loss of the purchasing power of that currency.

Additionally, Law No. 23,928, modified by Law No. 25,561 shortly after the economic crisis of 2001, reinforces this position by explicitly forbidding monetary restatements on such obligations. As section 7 of Law No. 23,928 states:

“The debtor of an obligation to give a determined sum of pesos fulfils its obligation by giving, on the obligation’s expiration date, the amount nominally expressed. In no case shall monetary restatement, price indexation, cost variation or reinforcement of debts be admitted, whatever their cause, whether the debtor is in arrears or not, with the exceptions provided for in the present law”.

Proponents of this position also sustain the idea that the quantitative or nominal cap will also be enforceable against any third-party claiming indemnity from the insurer. Pursuant to the Argentine Insurance Law (Law No. 17,418), in civil liability lawsuits the ruling will be enforceable against the insurer “to the extent of the insurance“. That is to say, pursuant to the contract and, specifically, the coverage limit. In this sense, several court decisions have supported this view, such as the 2017 leading case “Flores, Lorena Romina v. Gimenez, Marcelino Osvaldo y otro s/Daños y Perjuicios” of the Argentine Supreme Court of Justice (the “Court”), which ultimately determined that the ruling cannot exceed the coverage limit set, in this particular case, in 1993 (which represented a low value at the time of the ruling).

The Court based its decision on the following:

1. The insurer is bound to maintain the insured’s wealth unharmed to the extent of the insurance.

2. The contractual limits agreed, based on the autonomy of the parties in their contractual affairs, is the reasonable exercise of a risk limitation.

3. The insurer’s obligation to compensate the damage is purely of a contractual nature. Therefore, there are no legal grounds for claiming that the insurer should withstand payment of the compensation beyond the quantitative limitations established in the contract.

It is also important to note that section 61 of Law No. 17,418 states that the insurer will only pay up to the amount agreed in the contract, thus reinforcing this view that the coverage limit shall be taken into account as per its value stated in the policy.

Positions in favour of adjustment

Contrary to positions which state that coverage limits should remain unchanged, others believe that there are several reasons and methods to update it. In this sense, several courts have established that the insurance company’s duty to compensate the claimant does not comprise obligations of paying sums of money, but instead of paying equivalent amounts of money in terms

of value. On sustaining this view, courts disregard section 7 of Law No. 23,928 which, as explained above, specifically prohibits indexation.

In 2018, a ruling from the National Civil Chamber of Appeals (the “Chamber of Appeals”) in the case “Risser Patricia Elizabeth c/Maldonado Raul Americo y Otros s/Daños y Perjuicios” determined the reasons for which coverage limits were to be updated. This precedent, which is widely used by other courts to support the adjustment of coverage limits, considered, among other issues, that the problem arose when the coverage limit, originally stipulated by the SSN, was set long before the loss and remain unchanged, while compensation was calculated at the current value of money at the time. Section 7 of Law No. 23,928 was therefore deemed non-applicable, because courts were disregarding it in all their rulings by dictating that compensation amounts were to be calculated at current values. Consequently, in order for the claimant to obtain a fair compensation, it was imperative to update coverage limits which allowed the insurance company to pay compensations above the limit.

In this particular case, the Chamber of Appeals decided that the coverage limit was to be updated to the amount set by the SSN in its last resolution, which updated the mandatory coverage limits of auto insurance. From that moment on until the effective date of payment, the limit was to be updated once again in accordance with the Consumers’ Price Index.

Under this view about fairness of compensation, other courts have ruled in favour of coverage limit adjustment by either taking into account the updates set by the SSN or the Consumers’ Price Index, or common indexation methods used by courts.

It is important to note that both the National Civil Chamber of Appeals and the National Commercial Chamber of Appeals, as well as provincial courts, have widely used this sort of arguments in other rulings.

Conclusions

Inflation is without a doubt a problem that affects countries, economies, businesses, and insurance contracts too. In the case of Argentina, the discrepancy between the two positions described above evidence that courts do not have a unique or constant approach.

This lack of a constant approach to the issue gives rise to a problem of legal certainty, in which insurance contracts are constantly being revised by courts and where insurance companies lack certainty about the payable amounts of money they will be bound to pay.

In view of this, it is of utmost importance that courts in Argentina turn to a more consistent approach to evaluate the possibility of updating coverage limits, or in a more beneficial sense, that laws are enacted in order to address the issue.

Insuralex Argentine:

Franco Blanklejder – Associate

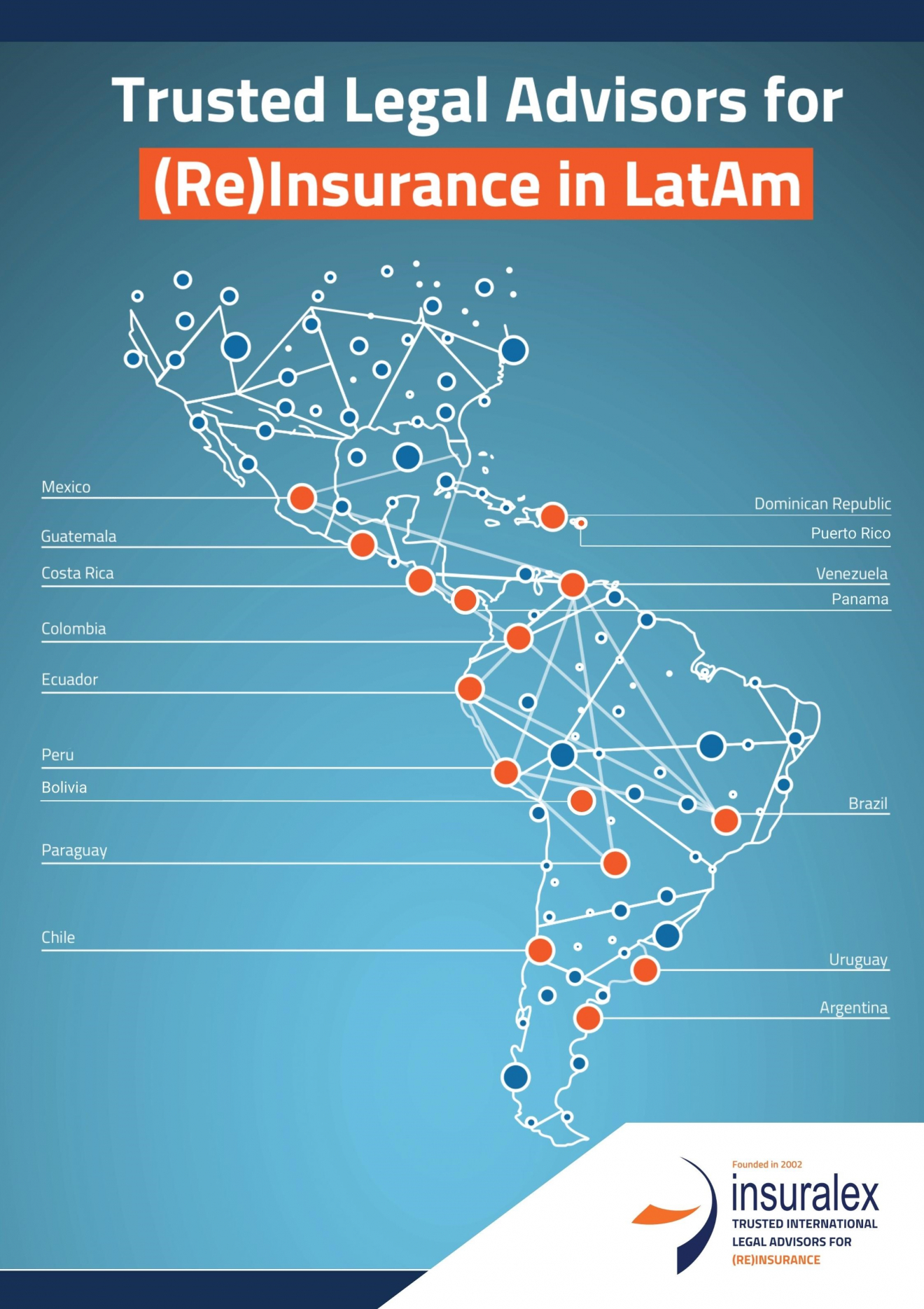

About Insuralex:

Founded in 2002, Insuralex is a worldwide network with more than 50 independent law firms that specialize in insurance and reinsurance coverage, defense, litigation, regulatory and corporate matters, and related legal services. Its members work for a wide range of clients including insurance and reinsurance companies, Lloyd’s syndicates, insurance, and reinsurance brokers as well as captives and self-insured companies. Each member firm of Insuralex is a leader in its national or state jurisdiction on issues related to insurance and reinsurance.

Insuralex is particularly recognized in complex claims that require a high specialization and that have an international component that requires specialized knowledge in diverse jurisdictions. Its members are also recognized for providing legal advice to the insurance industry on corporate and regulatory matters.

With more than 20 years of continuous growth, Insuralex has become the world’s leading insurance and reinsurance network with a highly recognized recommendation from our partners and clients within the insurance and reinsurance industry.

Insuralex Latin American insurance law practice covers countries such as: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Guatemala, Mexico, Panama, Paraguay, Peru, Puerto Rico, Uruguay and Venezuela.