Disrupting insurance: how technology, data and digitalisation are changing the industry

The face of insurance is changing. Again. Led by data, digitalisation and a need to engage the customer, there are already many shifts underway.

This current round of technology-driven change differs from those of the past, not least because of the speed and scale involved. Harnessed properly, these powerful forces offer new hope for the insurance industry to remain central to the lives of its customers. Swiss Re’s Sigma report Data-driven insurance, ready for the next frontier? explains what’s going on and presents a potential roadmap for progress.

“Everybody wants to be customer-centric,” says Evangelos Avramakis, Head Digital Ecosystems R&D, Swiss Re Institute. “Digital technology provides an opportunity to really see things from the customer’s perspective when designing new products and services.”

Customer expectations are setting the pace

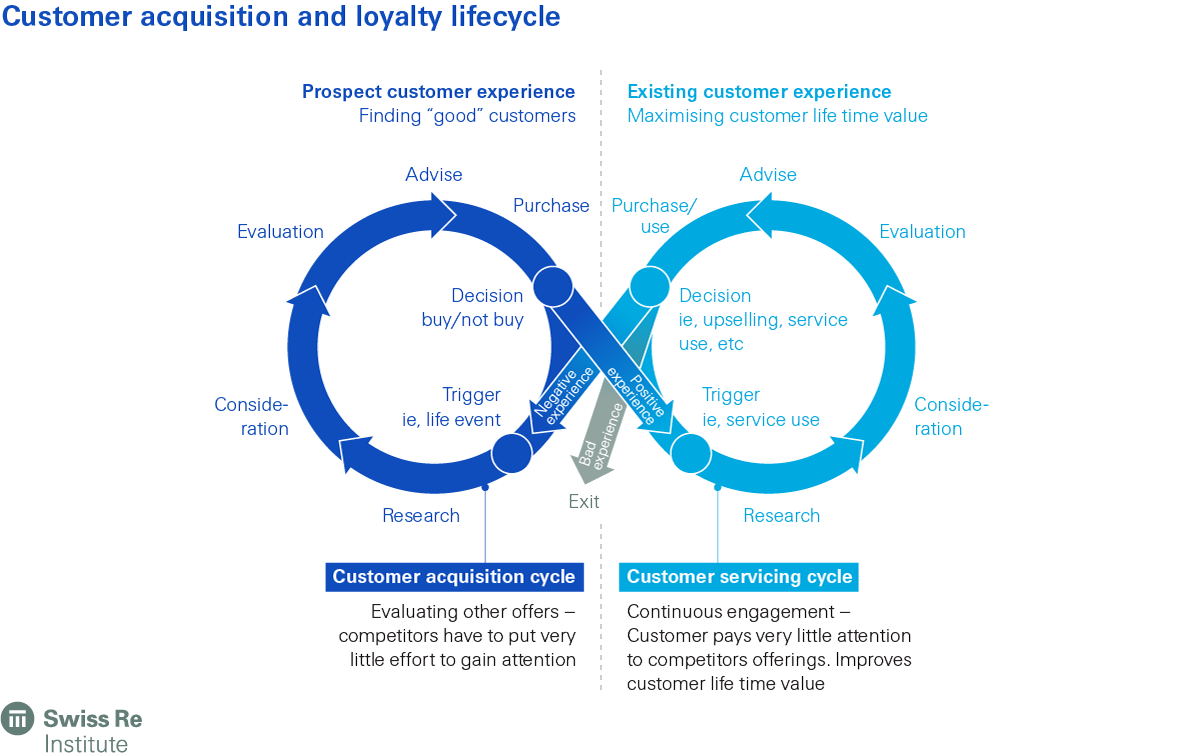

One of the clearest ways to visualise how digital technology is impacting insurance is to think of the customer journey.

Fig 1: Forecast growth of digital data (Source Swiss Re Institute)

At every stage – assessing their needs, researching the options, interacting with insurers and making a choice – customers are evaluating potential providers, and making comparisons that go much further than a simple assessment of Insurer A vs Insurer B.

As Avramakis explains: “Customer expectations are rising fast because insurance companies’ customers may already be using multinational ride-hailing or e-commerce companies – businesses that go to great lengths to ensure fast, effective consumer-focused experiences.”

Jonathan Anchen, Head of Swiss Re Institute Research & Data Support, wonders how the insurance industry could be affected by customers’ interactions with this kind of forward-looking digital experience. “If you have a problem with a property you’ve rented, you take a photo with your phone and upload it. It’s kept simple for the customer.”

“It’s not a direct comparison, of course. But that emphasis on a frictionless customer experience is shaping the way people expect to interact in the digital sphere.”

As customer interactions broaden out into this constantly evolving ecosystem of digital touchpoints, there will be more opportunities for insurers with innovative products to find suitable ecosystem partners.

A customer renting a property may have an insurance requirement – perhaps in case their over-excitable dog damages something and they lose their security deposit. Where would they be likely to purchase their additional cover? If they could bundle it with their rental transaction, they might appreciate the ease that offers.

Continue reading the article: Data-driven insurance: ready for the next frontier?

Source: Swiss Re Institute