This time we at iNLIP are putting together (one single post) 3 interesting Latin American Insurance Industry related reports by Insuralex (Global Insurance Lawyers Group)

Please bear in mind that you can always search past published articles using the “search box” and also looking at the “categories” box.

1. 2020 Parametric Insurance in Latin America: An overview

The use of parametric insurance in Latin America as an alternative to traditional indemnity-based insurance has increased over the last twenty years, particularly as a mechanism for insuring against extreme weather risks.

Following the aforementioned increasement, parametric insurances in Latin America have not received a standardized legal treatment from the local regulators. Every country has developed its applicable normative, at its sole discretion, depending on the requirements of the local insurance markets.

Notwithstanding, the following are the main regulatory trends for parametric insurances in the region which will be explained herein:

- Countries where the local regulation does not provide nor mention any applicable law for parametric insurances and, therefore, as it is not explicitly forbidden, it is deemed permitted.

- Countries where the local regulation accepts parametric insurance.

- Countries where the local regulation and the parametric insurances commercialization are only for agriculture and livestock practices.

Download the 2020 Parametric Insurance in Latin America report

2. 2020: Taxation on reinsurance premiums in Latin America

The world’s main reinsurance markets typically provide its services on a cross-border basis for Latin American based cedants, considering that the reinsuring capacity within the region is limited, in comparison to the insurance companies’ demand.

Consequently, these cross-border transactions imply taxation difficulties for the local governments of the country where the cedants are domiciled, as the foreign reinsurers collect the premiums whilst located in other jurisdictions.

Therefore, most of the Latin American tax authorities have adopted withholding tax rates for outbound reinsurance premiums payable by local cedants to foreign reinsurers.

Herein, readers will find a comparison of the withholding tax rates applicable in the region.

Download the report “2020: Taxation on reinsurance premiums in Latin America”

3. 2020 (Re) Insurance arbitration in Latin America report

The use of alternative dispute resolution mechanisms for insurance and reinsurance has become a growing practice in Latin America.

In particular, arbitration has been widely accepted as offering flexibility, celerity and high qualified and specialized arbitrators, generating confidence, guaranteeing access to the administration of justice and relieving congestion in the ordinary jurisdiction Arbitration regulations in Latin America are not standardized within its different jurisdictions, as each country has determined their own rules governing this dispute resolution mechanism.

On the other hand, in international matters there is a greater degree of homogeneity as a result of the efforts of international commissions to modernize and harmonize international trade rules.

Herein, the readers will find a comparison of general aspects of the regulations of arbitration as a dispute resolution mechanism regarding (re)insurance matters within the region.

Download the report: 2020 (Re) Insurance Arbitration in Latin America

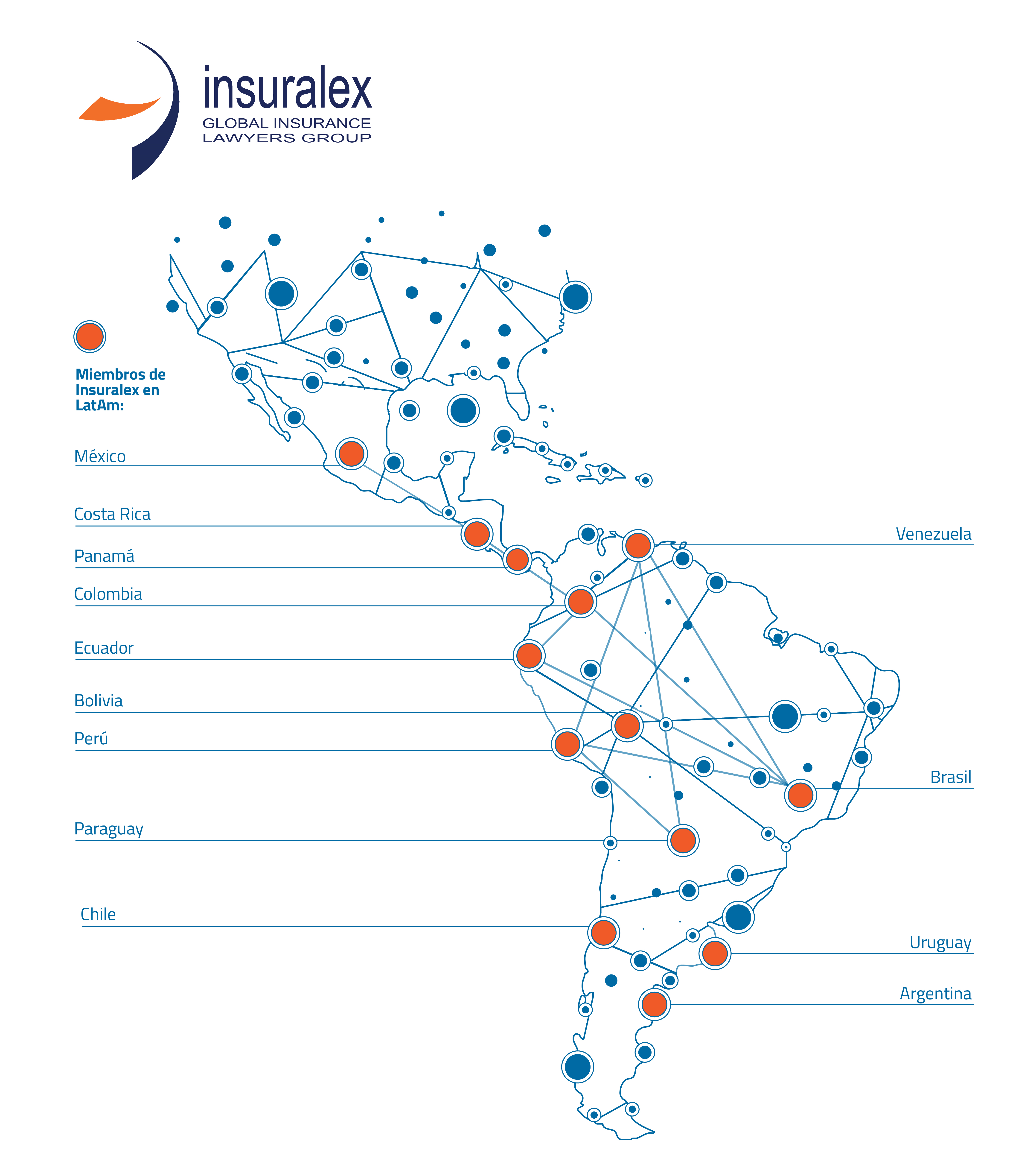

About Insuralex in Latin America

Insuralex is a group created by independent law firms that specialise in Insurance and Reinsurance coverage, defence, litigation and all other related legal services.

Insuralex works for a wide range of clients including insurance and reinsurance companies, Lloyd’s syndicates, insurance and reinsurance brokers as well as captives and self insured companies.

Each member of Insuralex is considered to be a leading practice in this specialist field within its national jurisdiction.

Insuralex Latin American insurance law practice covers countries such as: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Ecuador, Mexico, Panama, Paraguay, Peru, Uruguay and Venezuela.