The latest iNLIP´s post presents the Sigma report: Natural catastrophes and inflation in 2022

The loss generating power of nature, alongside the socio-economic and geopolitical crises of recent years helped pushed property reinsurance rates to 20-year highs in the January 2023 renewals season.

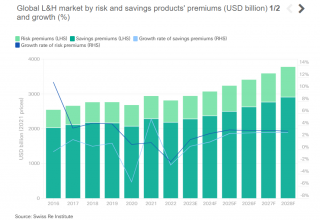

Global economic losses from natural disasters mounted to USD 275 billion in 2022. At USD 125 billion, insured losses covered 45% of the damage, the fourth highest total for a single year on sigma records. Today, annual global insured losses of more than USD 100 billion from natural catastrophes are standard.

A prevailing economic storm in 2022 was high inflation, which, by raising the nominal value of buildings, motor vehicles and other fixed assets that insurers cover, pushed up claims to cover the cost of repairs. Hurricane Ian was the costliest event of 2022, resulting in insured losses estimated at USD 50-65 billion. The storm made landfall in an area of high economic value, urbanisation and population growth, demonstrating the role these factors play as the main drivers of heavy losses inflicted by natural catastrophes.

Rising losses from catastrophes point to the need for full understanding of all risk factors, in particular with respect to secondary perils, which are not always monitored as closely as primary peril risks. The 2022 loss experience offers insights for re/insurers including a need for better monitoring and sharing of granular exposure data; the importance of observation periods and a debiasing of historical losses; and the need for models and underwriting decisions to adjust readily to rapidly changing physical and socio-economic conditions.

We expect hard markets conditions to persist in 2023, based on rising demand for coverage and inflation-driven higher values of insured assets. On the supply side, a reduction in risk appetite on the part of capital providers has constrained market capacity. Interest rate hikes to fight inflation have also played a role, by increasing the cost of capital and reducing the value of financial assets.

Get the Sigma report: Natural catastrophes and inflation in 2022

By

Source: Swiss Re Institute

Dowload other insurance reports: