“The main lines of business to benefit will be engineering and property premiums. There will also be increased demand for marine and liability insurance”.

Beyond the global recession shock inflicted by the COVID-19 pandemic this year, emerging markets are forecast to grow by around 4.4% annually over the next decade, slower than the yearly average of 5.5% in 2010-19. Against the weaker growth backdrop, emerging economies need to improve productivity. Here counter cyclical investment in infrastructure can play a key role.

Focus on sustainable infrastructure

Based on current spending trends and economic growth forecasts, sigma estimates that collectively, the emerging markets will invest an average of USD 2.2 trillion (3.9% of GDP), annually in infrastructure to 2040, making up two thirds of global spend.

The largest share of the investment will be in energy infrastructure (34%), with a focus on renewable energy as countries seek to reduce their greenhouse gas emissions. Other growth areas will include smart cities and infrastructure, in which data and digital technology facilitate more efficient solutions such as by monitoring and managing public transport, and utilities like waste disposal systems and power grids.

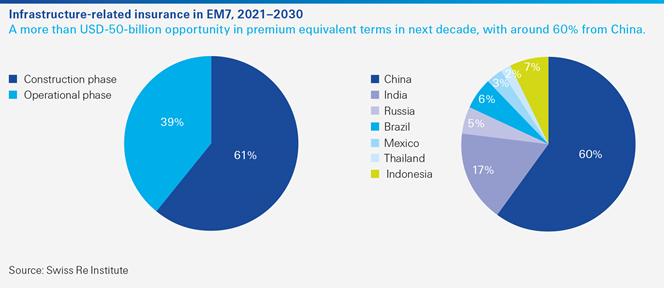

Emerging Asia will be where most new infrastructure is built, with total investment estimated to average USD 1.7 trillion annually over the next 20 years, or 4.2% of GDP, accumulating to USD 35 trillion in total. China will invest USD 1.2 trillion (4.8% of GDP) each year, accounting for 35% of global and 54% of all emerging market investment in infrastructure. Africa will invest an estimated 4.3% of GDP on infrastructure, but absolute levels will be low. Emerging Europe will invest 3% of GDP in infrastructure, in line with the global average, but spending in Latin America will lag.

Insurers as long-term investors…

Traditionally, emerging markets have relied mostly on public funding for their infrastructure needs. With government budgets under strain, the private sector will play an increasing role, for example via public-private partnerships.

The infrastructure sector in emerging markets presents an annual USD 920 billion opportunity for long-term investors, including global insurers.

…and underwriters

Insurers can also underwrite the risks inherent in infrastructure projects in emerging markets, and the sigma estimates an associated total premium opportunity of more than USD 50 billion over the next 10 years.

The main lines of business to benefit will be engineering and property premiums. There will also be increased demand for marine and liability insurance.

Source: Swiss Re Institute Sigma