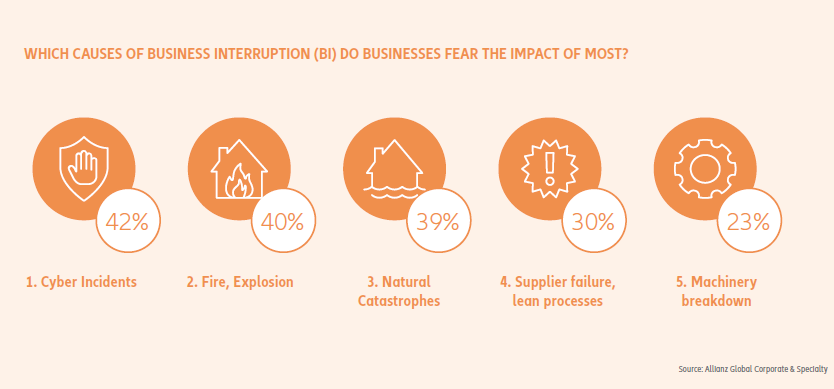

Business interruption (BI), including supply chain disruption, is the top risk for companies for the sixth consecutive year, according to the Allianz Risk Barometer 2018, with 42% of responses rating it as one of the three most important risks in 2018. Whether it results from factory fires, destroyed shipping containers, or increasingly, non-physical damage risks like cyber, political violence, product recall or similar incidents, BI has tremendous effects on revenue.

Consider recent events such as Hurricane Florence that struck the Carolinas in September 2018. In addition to the businesses that were directly impacted, businesses outside of the storm areas could experience lost revenue as a result of damage suffered by suppliers or customers whose operations were damaged by the storms.

Companies often underestimate the complexities of getting back to business. According to the US Federal Emergency Management Agency (FEMA), 40% to 60% of small businesses never recover after a disaster.

It is important to have a business continuity plan (BCP), which clearly delineates the business’ plan for operational recovery after a disaster, in place so that the delay is mitigated and BI losses are limited.

“Having a business continuity plan prepares you in the event of a break in your supply chain or manufacturing process. Not having one exposes you to lost edge in the marketplace, lost sales and even reputational damage,” explains Rajiv Iyer, Global Head of Package and Small Business, AGCS.

Source: Allianz